With many economists still predicting an imminent RBA cash rate cut, whether at this afternoon's meeting or later in 2020, financial comparison site RateCity has put figures to the doubts swirling around if another reduction would actually benefit mortgage holders.

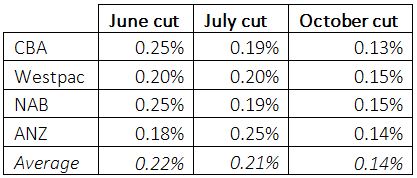

In 2019, the official cash rate was reduced by 25 basis points (bps) in June, July and October.

After October's reduction, the big four banks passed on an average of just 14bps to their owner-occupier variable rate customers paying P&I.

If the rate cut had been passed on in full, the average mortgage holder could save $56 a month in repayments. However, just 15bps being passed along translates to savings of only $34 per month, and a10bps reduction would see just $23 saved every four weeks – based on a $400,000 mortgage paying P&I.

The muted impact of subsequent cuts is more likely to be felt among existing customers.

“If the RBA moves, new customer rates are likely to hit another low, however existing customers shouldn’t assume they’ll get the full cut,” explained RateCity research director Sally Tindall.

“Last October, the big four banks passed on an average of 0.14[bps]. I wouldn’t expect more than that this time around. In fact, in this low rate environment, some variable rate customers will be lucky to get half."

The pass-through from the big four after each 2019 RBA rate cut

Note: For owner occupier variable customers paying P&I

“The record-low cash rate is problematic for the banks. Many banks’ base savings rates are within 0.25 per cent of zero, making it near impossible to pass on full cuts to depositors," said Tindall.

“If the RBA does fire off another cut, banks will have to weigh up the competing interests of borrowers, depositors and shareholders.”

No comments:

Post a Comment