Leases aren't meant to be broken but circumstances can always change.

http://ljgrealestate.com.au/competitive-commission/

http://ljgrealestate.com.au/property-management/

http://ljgrealestate.com.au/competitive-commission/

http://ljgrealestate.com.au/property-management/

When it comes to home ownership, timing can prove to be definitive.

Unfortunately, making a move on the perfect home can come at the expense of a leasing agreement.

If you're thinking about leaving behind your lease prematurely, it's best to know where you stand from a regulatory standpoint.

What does breaking the lease look like?

A lease is a legally binding agreement that comes with its own set of terms and conditions.

If a tenant decides to vacate a property before the end of the lease term (referred to as the fixed term agreement) without sufficient reason, they are breaking the lease or rental agreement.

The resulting loss of rent means compensation may need to be paid to the owner (or property manager).

According to the lease agreement, if a tenant leaves the rental property with two months left on the lease they technically owe the owner (or property manager) those two months rental even if they aren’t living there.

Breaking the news about breaking the lease

Both tenants and landlords must notify the other party in writing if they intend to terminate the lease.

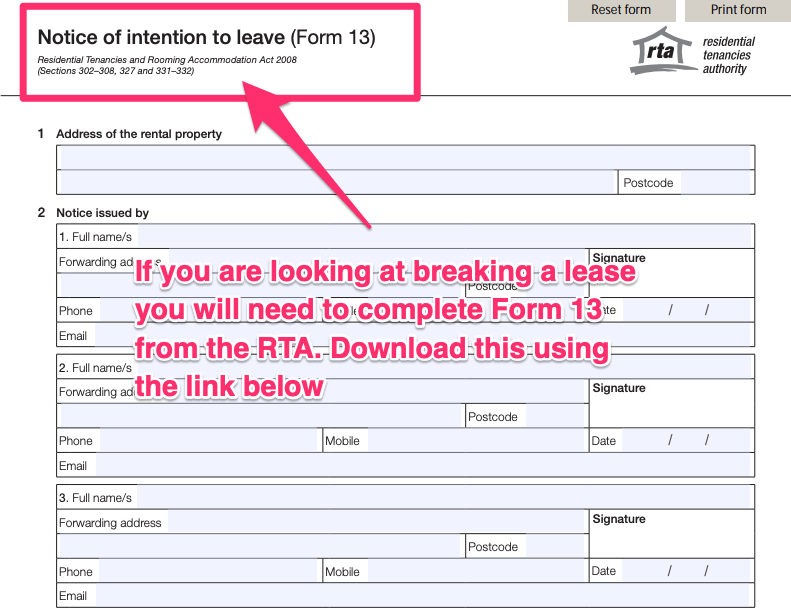

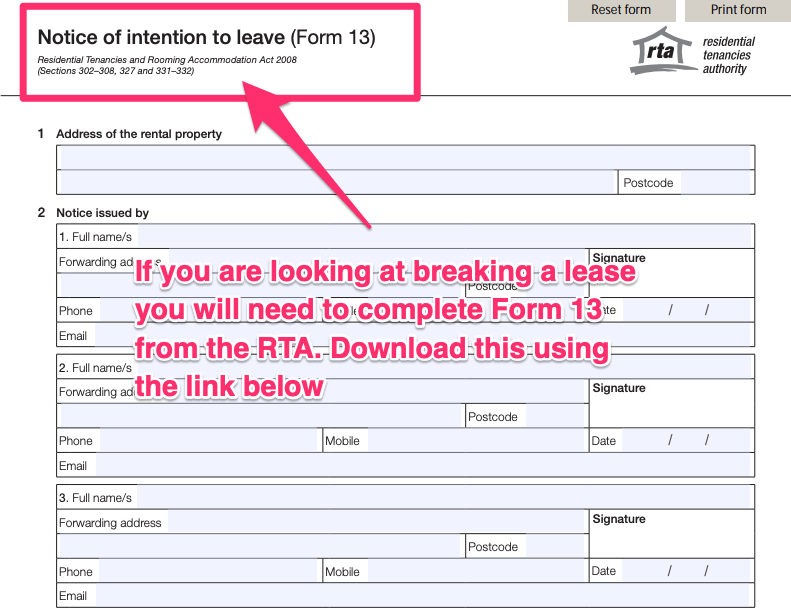

As a tenant, if you want to notify the landlord of your intention to leave, complete a Form 13.

Supplied: Hunter Galloway

In Queensland, this is done through the Residential Tenancies Authority of Queensland (RTA), with a tenant providing Notice of Intention to leave to a property manager/owner when they want to vacate the property by a certain date.

A completed Form 13 is required to end a periodic agreement (i.e. if you’re paying month to month), end a fixed term agreement (i.e. if you have X months left on your lease), or ff they have grounds to end a fixed term agreement early, or if they are breaking the lease.

Tenants must send the form to the property manager for processing.

Reasons why a lease might be terminated

Some circumstances are unavoidable. The death of a sole tenant or a mortgagee giving notice are among the reasons why a lease might be terminated.

For first home buyers, the most realistic option is a written agreement between them and the landlord that the leasec is over.

Do I need to pay any costs when breaking my lease?

According to the RTA, the tenant may be asked to pay:

- Reasonable re-letting costs – usually one week’s rent plus GST

- Reasonable advertising costs (if incurred), and

- Compensation for loss of rent – until a new tenant is found or until the end date of the agreement whichever happens first.

The property manager or owner is legally required to minimise the costs associated with breaking the lease. At any time if the tenant feels that the property manager or owner are not mitigating this loss, contact the RTA for help.

What could these costs potentially look like?

Let’s run with the above scenario, the tenant has found the perfect home but has two months left on their lease which costs $500 per week.

Worst case scenario is that they might be required to cover:

- Reasonable re-letting costs – one week's rent = $500

- Reasonable advertising costs = $100

- Compensation for loss of rent = It took four weeks to find a new tenant 4 x $500 = $2,000

So it could cost the tenant an extra $2,600 in rent to break their lease early to buy a home.

What are some ways you can break the lease without costs?

There are ways to soften the financial blow that comes with breaking the lease agreement.

Giving the landlord adequate notice and helping them find a replacement tenant are examples of this.

Other ways to minimise the costs associated with breaking a lease include:

- Reducing advertising costs – Can also be reduced as the tenant should only be reasonably expected to contribute to the advertising costs. What this means is if the tenant has 50 per cent of their lease left, say they are six months into a 12-month lease, the tenant should only pay 50 per cent of the advertising fee. If they have three months left on a 12-month lease then they should only pay 25 per cent, etc.

- Check for a break of contract – As part of the lease, the property owner agrees to maintain the property and provide a safe environment. Unfortunately not every property owner lives up to their side of the deal, and if they ignore requests to fix broken appliances, sort dodgy plumbing or if there is mould or insect problems, the tenant could say they have breached their lease contract.

If the property manager and tenant mutually agree, any tenancy agreement can be terminated at any time. So these figures are the worst case, but its worth having a chat with the property manager to see what can be worked out.

When is my tenancy agreement terminated?

Legally speaking, the lease is not broken until the tenant has given back vacant possession of the rental property – i.e. they've completely moved out.

If the tenant believes they've been placed under excessive hardship by the property manager or owner, they can apply for excessive hardship through QCAT provided they have evidence to support the application.

AT A GLANCE

• Property management & Sales of Tenanted Investment Properties is our Speciality - Core Business.

• Individual solutions to fit our client's needs

• Body corporate management

• Competitive Commission Rates

• LET FEE FOR REFERRALS, We are a business built on 20 years of Referrals.

• NO Lease Renewal & Comparable Market Analysis’ Fees/Charges

• PHOTOS TAKEN ON ENTRY, tenants are shown about safety switches and water mains etc. We meet all tenants on site.

• A hands-on approach to all Property Investment Management Matters.

Dedicated to implementing best practice, achieving set goals and encompassing a consistent approach to quality management and making effective use of all available technology. We recognize that tenants are customers too, treating them with any sort of disrespect would be detrimental to all property investors. It is all about Attitude. We Aim to remove the hassle from Sales & Rentals.

• Property management & Sales of Tenanted Investment Properties is our Speciality - Core Business.

• Individual solutions to fit our client's needs

• Body corporate management

• Competitive Commission Rates

• LET FEE FOR REFERRALS, We are a business built on 20 years of Referrals.

• NO Lease Renewal & Comparable Market Analysis’ Fees/Charges

• PHOTOS TAKEN ON ENTRY, tenants are shown about safety switches and water mains etc. We meet all tenants on site.

• A hands-on approach to all Property Investment Management Matters.

Dedicated to implementing best practice, achieving set goals and encompassing a consistent approach to quality management and making effective use of all available technology. We recognize that tenants are customers too, treating them with any sort of disrespect would be detrimental to all property investors. It is all about Attitude. We Aim to remove the hassle from Sales & Rentals.

Best Regards

Linda 姬琳达珍 and Carlos Debello (LREA)

LJ Gilland Real Estate Pty Ltd

PO BOX 19

ZILLMERE 4034

Ph: 07 3263 6085

ZILLMERE 4034

Ph: 07 3263 6085

0413 560 808

0400 833 800

0409 995 578 (L)

No comments:

Post a Comment