Housing affordability best since 1999, say HIA

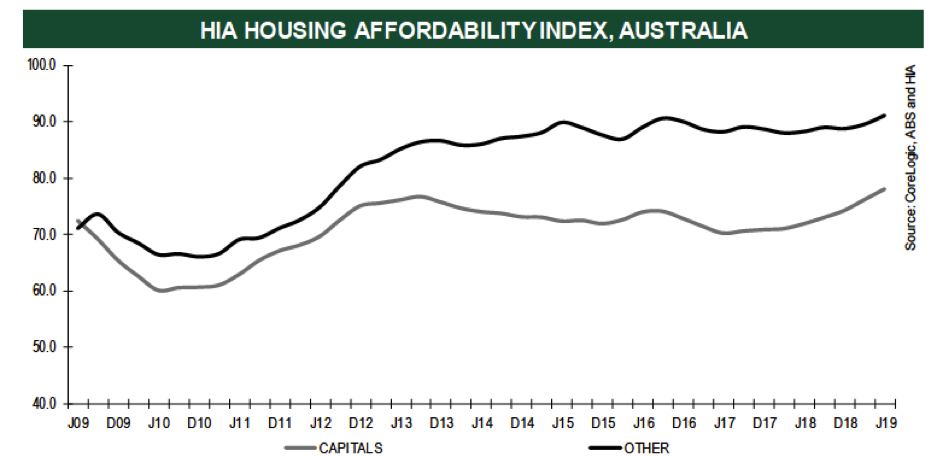

All eight capital cities saw an improvement in the Housing Industry Association Affordability Index for the June 2019 quarter, with Darwin showing the greatest improvement, its index up by 4.8 per cent. Combination of lower home prices, improvements in wage growth and lower interest rates have contributed to the ongoing improvement in the HIA Affordability Index for the June 2019 quarter, according to Housing Industry Association (HIA) Senior Economist, Geordan Murray.

All eight capital cities saw an improvement in the HIA Affordability Index for the June 2019 quarter, with Darwin showing the greatest improvement, its index up by 4.8 per cent. This was followed by Melbourne (+3.0 per cent), Perth (2.6 per cent), Brisbane (+2.6 per cent), Sydney (+2.4 per cent), Canberra (+ 2.4 per cent), Hobart (+ 2.2 per cent) and Adelaide (1.0 per cent).http://ljgrealestate.com.au/property/36-grand-terrace-waterford-qld-4133/?lang=es

HIA’s Affordability Index is calculated for each of the eight capital cities and regional areas on a quarterly basis and takes into account the latest dwelling prices, mortgage interest rates, and wage developments.“For a home buyer with an average income purchasing a median-priced dwelling (assuming a 10 per cent deposit), mortgage repayments will consume the smallest proportion of their earnings since 1999,” added Mr Murray.

“The main reason the HIA Affordability Index today is comparable with the level in 1999, despite house prices rising significantly faster than incomes, is that interest rates are 4.6 per cent today compared with 6.7 per cent in 1999.

“Average earnings have increased by 113 per cent over the 20 years to 2019, while the median home price has increased by 228 per cent but the lower interest rates have kept the cost of servicing a loan the same," he said.

Source: HIA

“There are also a number of initiatives that do not feed into this Affordability Index that will assist with first home buyers entering the market. The reduction in income tax, the easing of APRA restrictions on mortgage lending and the Australian government’s First Home Loan Deposit Scheme are likely to be important considerations for households.

“Despite a significant improvement in affordability Sydney remains the least favourable market in the country, requiring 1.8 times the average income to service a mortgage on a typical Sydney home,” said Mr Murray.

TWO STRATA

TITLED 4 BED HIGH SET STRATA TITLED UNITS WITH PROPERTY RETURNS OVER $52,000 A

YEAR.

AN

OPPORTUNITY HERE FOR AN ASTUTE INVESTOR – YIELDS OVER 5% EACH PROPERTY AND

INCOME

PRODUCING STRATA TITLED AIR-CONDITIONED 3 BEDROOM DUPLEX'S WITH STUDY NOOK

GREAT FOR YOUR SUPERANNUATION

PORTFOLIO! CAPITAL GROWTH ASSURED!

AND THE RENT HAS GOOD POTENTIAL TO MOVE UP 5-10%

Each

house/dwelling is separately titled, as houses on any estate.

You

can do anything internally that meets the local council rules.

Body

corporate only exists to ensure each owner has a say in the external

presentation of the duplex. The Vendor is not aware of any joint costs for

services, other than building insurance of the duplex is paid by the Body

Corporate for both dwellings.

For

this reason there are no sinking fund or other fees.

The

funds go to the body corp to pay the insurance bill and the building insurance

is cheaper as a duplex than as two separate houses.

The building is a duplex only because the two buildings are joined by a fireproof

garage wall, maximizing the use of the land. These houses are houses in their

own right.

TWO

STRATA TITLED 4 BED HIGH SET STRATA TITLED UNITS WITH PROPERTY RETURNS OVER

$52,000 A YEAR.

AN

OPPORTUNITY HERE FOR AN ASTUTE INVESTOR – YIELDS OVER 5% EACH PROPERTY AND

INCOME

PRODUCING STRATA TITLED AIR-CONDITIONED 3 BEDROOM DUPLEX'S WITH STUDY NOOK

GREAT FOR YOUR SUPERANNUATION

PORTFOLIO! CAPITAL GROWTH ASSURED!

AND THE RENT HAS GOOD POTENTIAL TO MOVE UP 5-10%

IN THE HEART OF SPRINGWOOD

THESE DUPLEXES OFFER ALSO THE CHANCE FOR AN EXTENDED FAMILY TO LIVE TOGETHER OR

FOR AN ASTUTE INVESTOR TO CONTINUE TO RENT OUT BOTH PROPERTIES WHICH SET THE

PRECEDENT IN RENTS FOR THE SPRINGWOOD

LOCATION LOCATION LOCATION - SEIZE THIS FANTASTIC PROPERTY

INVESTMENT OPPORTUNITY....

EXECUTIVE STYLED INCOME PRODUCING STRATA TITLED

AIR-CONDITIONED 3 BEDROOM DUPLEX'S WITH STUDY NOOK PROPERTY INVESTMENT

OPPORTUNITY

We are marketing

these properties as Duplex's or a Units individually and the Vendor is happy to

discuss prices.

You have the

Opportunity to Buy One or Both Units.

AS INDIVIDUAL UNITS

OR PAIRS.

THE VENDOR WANTS

MID $500,000 A T/HOUSE FOR HIGH SET AND MID $400,000 EACH FOR LOW SET.

AS PAIRS - UP TO 5%

DISCOUNT

HIGH SET FROM

$1,120,000 DISCOUNT TO SAY $1,064,000

LOW SET FROM

$940,000 DISCOUNT TO SAY $893,000

We look forward to

hearing from you to open discussions and interest in these Valuable Investment

Opportunities, as individual Units or Pairs.

http://ljgrealestate.com.au/property/19-tower-street-springwood-qld-4127/

AT A GLANCE

• Property management & Sales of Tenanted Investment Properties is our

Speciality - Core Business.

• Individual solutions to fit our client's needs

• Body corporate management

• Competitive Commission Rates

• LET FEE FOR REFERRALS, We are a business built on 20 years of Referrals.

• NO Lease Renewal & Comparable Market Analysis’ Fees/Charges

• PHOTOS TAKEN ON ENTRY, tenants are shown about safety switches and water mains etc. We meet all tenants on site.

• Hands on approach to all Property Investment Management Matters.

Dedicated to implementing best practice, achieving set goals and encompassing a consistent approach to quality management and making effective use of all available technology. We recognize that tenants are customers too, treating them with any sort of disrespect would be detrimental to all property investor's. It is all about Attitude. We Aim to remove the hassle from Sales & Rentals.

• Individual solutions to fit our client's needs

• Body corporate management

• Competitive Commission Rates

• LET FEE FOR REFERRALS, We are a business built on 20 years of Referrals.

• NO Lease Renewal & Comparable Market Analysis’ Fees/Charges

• PHOTOS TAKEN ON ENTRY, tenants are shown about safety switches and water mains etc. We meet all tenants on site.

• Hands on approach to all Property Investment Management Matters.

Dedicated to implementing best practice, achieving set goals and encompassing a consistent approach to quality management and making effective use of all available technology. We recognize that tenants are customers too, treating them with any sort of disrespect would be detrimental to all property investor's. It is all about Attitude. We Aim to remove the hassle from Sales & Rentals.

No comments:

Post a Comment